MobiKwik Share Price Analysis: Navigating Volatility in 2025

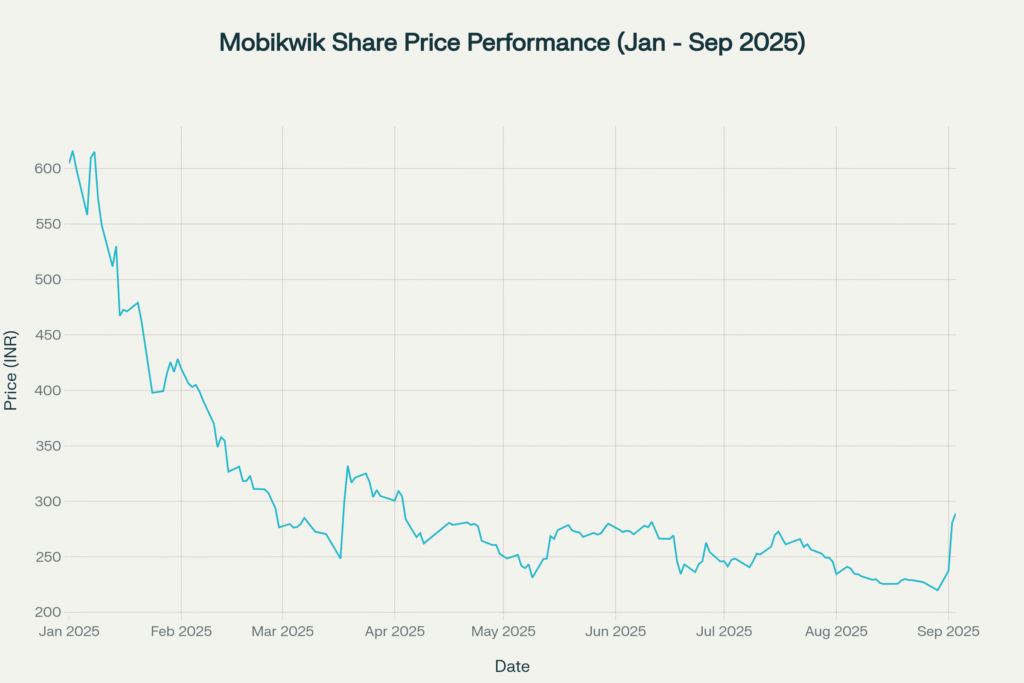

One MobiKwik Systems has emerged as a compelling case study in stock market dynamics, showcasing both the potential and challenges of fintech investments in India. Trading at ₹289 as of September 3, 2025, the digital payments company has experienced significant volatility since its December 2024 listing, presenting investors with both opportunities and cautionary tales in the rapidly evolving fintech sector.

Current Market Position and Performance

MobiKwik’s stock currently trades at ₹288.51 on the NSE with a market capitalization of ₹2,193.73 crores, representing a substantial decline of 52.21% from its post-listing price of ₹604.7. The company’s shares have demonstrated extreme volatility, with a 52-week high of ₹698.30 and a low of ₹219.20, reflecting the broader challenges faced by newly listed fintech companies in maintaining investor confidence.

Despite the overall downward trajectory since listing, September 2025 has brought renewed investor interest, with shares gaining 21.81% month-to-date and 18% over two consecutive sessions. This recent surge has been primarily attributed to significant institutional activity, particularly the complete exit of Abu Dhabi Investment Authority (ADIA), which sold its entire 2.1% stake worth ₹39.21 crores through block deals.

Mobikwik stock price chart showing significant volatility and decline from listing price of ₹604.7 to current levels around ₹289

Financial Performance: Mixed Signals

Revenue Challenges and Growth Areas

MobiKwik’s Q1 FY26 financial results revealed a complex picture of growth and challenges. The company reported a consolidated net loss of ₹41.92 crores, significantly higher than the ₹6.62 crore loss in Q1 FY25. Revenue from operations declined 20.7% year-on-year to ₹271.36 crores, down from ₹342.27 crores in the previous year.

The revenue decline was primarily driven by a sharp 65% drop in financial services revenue, falling from ₹170.7 crores to ₹58.3 crores year-on-year. This decline reflects the company’s strategic decision to discontinue smaller-ticket Zip loans and focus on longer-tenure Zip EMI products, which management expects will improve performance in the second half of FY26.

Payments Business: A Bright Spot

Contrasting the overall financial challenges, MobiKwik’s core payments business demonstrated robust growth. Payments Gross Merchandise Value (GMV) surged 53% year-on-year and 16% quarter-on-quarter to reach ₹384 billion in Q1 FY26. The payments business achieved an all-time high gross margin of 28%, reflecting a 12% year-on-year expansion.

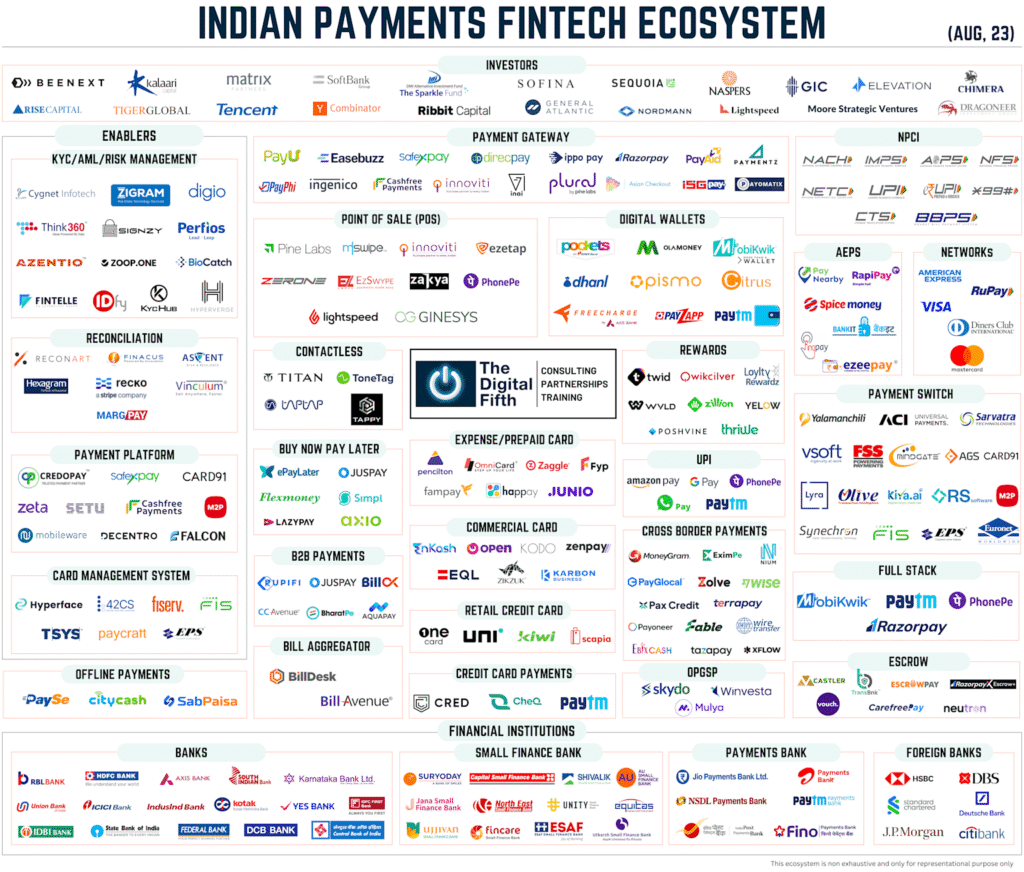

The platform’s user base grew to 180.2 million registered users, while the merchant network expanded to 4.64 million, supporting the strong payments performance. This growth validates MobiKwik’s position as India’s largest digital wallet, commanding a 23% market share of the PPI wallet gross transaction value.

Recent Market Developments

Institutional Activity and Investor Sentiment

The recent rally in MobiKwik shares has been catalyzed by significant block deal activity. ADIA’s complete exit through the sale of 16.44 lakh shares at an average price of ₹238.45 was absorbed by institutional buyers including BofA Securities Europe SA and SI Investments & Broking. This institutional reshuffling has been interpreted positively by retail investors, contributing to the stock’s recent momentum.

The investor base remains diversified with Peak XV Partners holding 9.92%, Bajaj Finance at 10.21%, and Cisco Systems maintaining 1.54%. Foreign institutional investors reduced their stake from 31.5% in Q4FY25 to 23.07% in Q1FY26, while retail shareholding increased from 21.8% to 28.1%, indicating growing retail investor participation.

IPO Performance and Market Reception

MobiKwik’s IPO, priced between ₹265-279 per share, was oversubscribed 119.38 times, raising ₹572 crores entirely through fresh issue. The stock listed at ₹440 on December 18, 2024, delivering a 57.71% listing gain to investors. However, the subsequent performance has been challenging, with the stock declining over 45% from its listing price.

Indian payments fintech ecosystem infographic highlighting key companies including Mobikwik in digital wallets and full stack payments

Business Strategy and Future Outlook

Diversification Initiatives

MobiKwik has been actively diversifying its business portfolio beyond traditional payments. The company recently received SEBI approval to operate as a stockbroker through its subsidiary MobiKwik Securities Broking Private Limited, enabling equity trading services. Additionally, the launch of Pocket UPI and AI-based chatbot platform LENS demonstrates the company’s commitment to innovation and service expansion.

The company’s financial services segment, despite current challenges, remains a key growth area. EMI disbursals increased 31% quarter-on-quarter to ₹6,931 million, with improving take rates of 8% and gross margins reaching 13.3%. Management expects this segment to strengthen in the latter half of FY26 as the strategic focus on longer-tenure products begins to show results.

Operational Efficiency Measures

MobiKwik has implemented several operational efficiency measures to improve profitability. Total expenses declined 9% year-on-year to ₹312.8 crores in Q1 FY26, largely due to reduced lending-related costs that fell to ₹29.1 crores from ₹92.3 crores. This cost optimization, combined with revenue growth initiatives, is expected to support the company’s path toward profitability.

Investment Considerations and Risk Factors

Analyst Perspectives

Despite recent financial challenges, Dolat Capital Markets maintains a ‘Buy’ rating on MobiKwik stock, indicating confidence in the company’s long-term prospects. The brokerage firm’s positive outlook is likely based on the company’s strong market position in digital payments and potential for recovery in financial services.

Risk Assessment

Investors should consider several risk factors when evaluating MobiKwik shares. The company has reported losses for four consecutive quarters, with negative earnings per share of -₹20.07. The high price-to-book ratio of 3.73 suggests the stock may be overvalued relative to its book value. Additionally, the volatile nature of fintech stocks, regulatory changes in the payments industry, and intense competition pose ongoing risks.

Market Volatility and Technical Indicators

The stock’s Relative Strength Index (RSI) of 52.5 indicates neutral momentum, while the 14-day RSI of 74.66 suggests the stock may be in overbought territory following recent gains. The significant volatility, with the stock being 5 times as volatile as the Nifty index, requires careful position sizing and risk management.

Conclusion

MobiKwik’s share price journey reflects the broader challenges and opportunities in India’s fintech sector. While the company faces near-term headwinds from declining financial services revenue and persistent losses, its dominant position in digital payments and strategic initiatives in new growth areas provide reasons for cautious optimism.

The recent institutional activity and retail investor interest suggest renewed confidence in the company’s prospects. However, investors should approach MobiKwik with a clear understanding of the risks involved, including ongoing profitability challenges and high market volatility. The company’s ability to execute its strategic pivot toward profitable growth while maintaining its market leadership in payments will be crucial for long-term value creation.

For potential investors, MobiKwik represents a high-risk, high-reward opportunity in India’s digital payments revolution. The stock’s recent performance demonstrates both the potential for significant gains and the risk of substantial losses, making thorough due diligence and careful risk assessment essential before investment decisions.